Selection from Olcott’s Land Values Blue Book, 1936 edition, Numbers represent values per front foot, to be adjusted as described in the book.

Assessor Fritz Kaegi appears to seek assessments that are more consistent with applicable laws and ordinances, and easier for taxpayers to understand. This might be a good thing, tho one hopes that, once taxpayers understand how assessments are done, they’ll demand a more helpful system, one which doesn’t punish homeowners and businesses for building or improving.

Traditionally, an owner of commercial or industrial property could assert that their operation is unprofitable, and therefore the assessment should be reduced. The most obvious case would be where the property was demonstrably vacant, but there are other possibilities also. Kaegi asked the State to require “large commercial property owners in the county to disclose income and expenses so his office could use the data to improve accuracy of the valuations on which property taxes are based.”

The bill has apparently failed for this session. But why should this information be needed, even under the current laws? You have a property, say a strip mall. It’s usually straightforward to estimate the land value, which provides a lower bound for total value. Strip malls are bought and sold routinely, providing another approach to value. If the property is vacant, perhaps it’s incompetently managed. So why subsidize that? Better if the incompetent manager/owner sell the property to someone who’ll make better use of it.

By ordinance, commercial and industrial property is to be assessed at 25% of value, with residential and vacant at 10%. We can see from the latest state report(pdf) that the actual ratio of assessment to sales price, countywide, is 8.47% for residential property, 19.40% for commercial and 19.41% for industrial. So residential is 84% of where is “should” be, and commercial/industrial 78%. That is consistent with some special factor being used to underassess commercial/industrial property. It may be noted that these figures are for 2017, which predates the current Assessor’s tenure.

In a related matter, Crain’s reported that Evanston “commercial properties have been walloped with soaring assessments.” In fact, in each of the six townships (Norwood Park, Evanston, New Trier, Elk Grove, Maine, Northfield) for which 2019 assessments have been reported, the increase in commercial/industrial assessments has been higher, usually much higher, than the increase in residential assessments. That doesn’t mean that these, or any assessments which includes improvement values, are “fair,” but it does imply that Kaegi is, more consistently than his predecessor, following the applicable rules.

If the commercial/industrial assessments largely survive the Board of Review and the Property Tax Appeal Board, then taxes for homeowners may decline, and/or revenue for taxing bodies may increase. However, we can also expect to see legislation for “tax relief” shifting much of the burden from commercial/industrial owners to others. Altho a serious candidate did recently propose elimination of improvements from the tax base, there is unfortunately no indication that this is being considered.

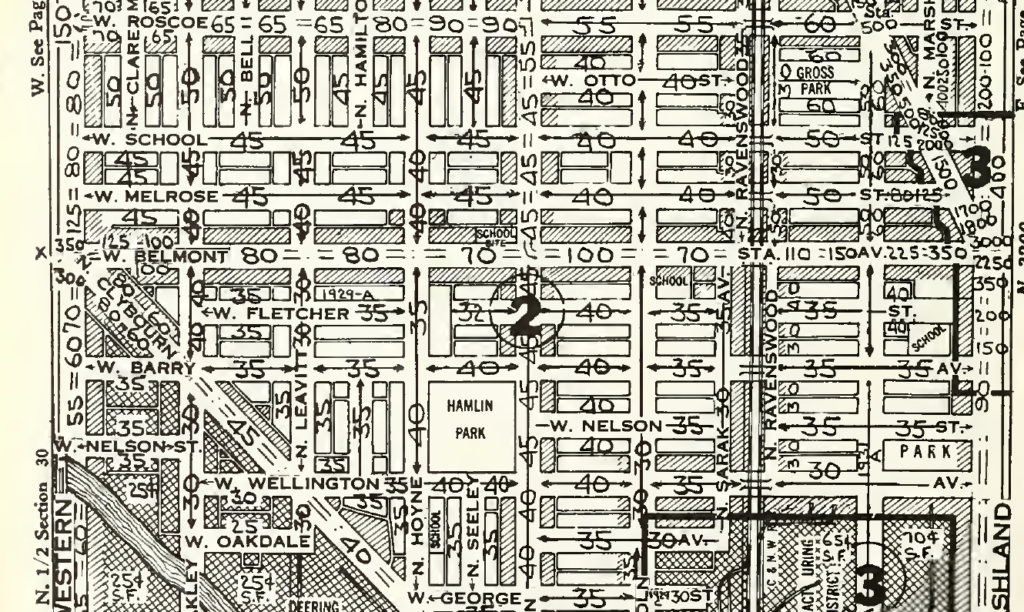

And finally, the International Association of Assessing Officers have assessed the Assessor’s office operations and concluded that more staff are needed. The report doesn’t treat the possibility of changing the assessment system to make it simpler and fairer, but merely to more efficiently execute the existing rules. It does note (page 22) that competent assessment under current rules does require better land valuation techniques, and anyone who has reviewed assessment data must agree that improvement is needed. Once good land value estimates are achieved, any appraisal based on construction cost or market values of buildings is a waste of public funds, required only due to failure of the legislative bodies to adopt a tax based solely on land value.